Are you tired of the high cost of health insurance? We are too!

Our Smart Healthcare Solution is designed for people who are relatively healthy

and prefer to choose the coverage options that best suits them and their family.

Why is Healthcare So Expensive?

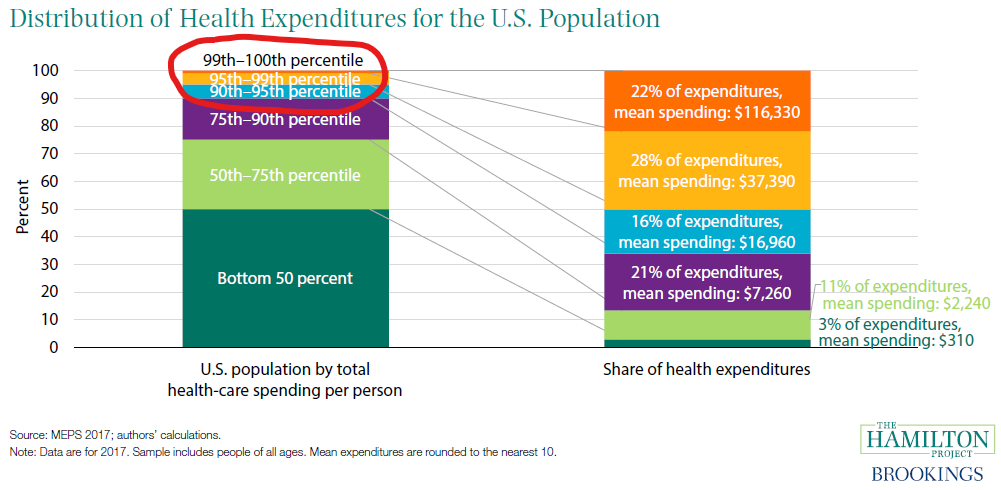

The reason healthcare is so expensive today is that 90% of the healthy people are paying for 10% of the people who are responsible for over 66% of the healthcare expenses. The healthcare system is not designed to be fair for relatively healthy people. See the chart below.

Contact the licensed agent who shared this with you for questions and a free quote.

There's a Better Solution

With the high cost of insurance, many employers are not offering healthcare or are only paying for the employee and not the spouse or family. The cost of adding your family to your employer plan can take your entire paycheck.

For self-employed or a business owner you simply don’t have a large employee group to qualify for large group rates and you don’t qualify for the State ACA subsidies.

The Better Solution! The Smart Healthcare Solution we offer is designed for people who are relatively healthy and the savings are passed on to you with lower rates. We save people 20%-70% on healthcare costs.

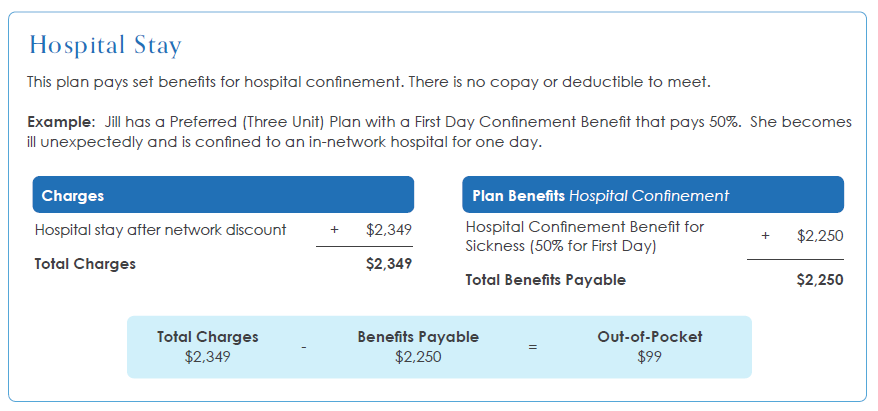

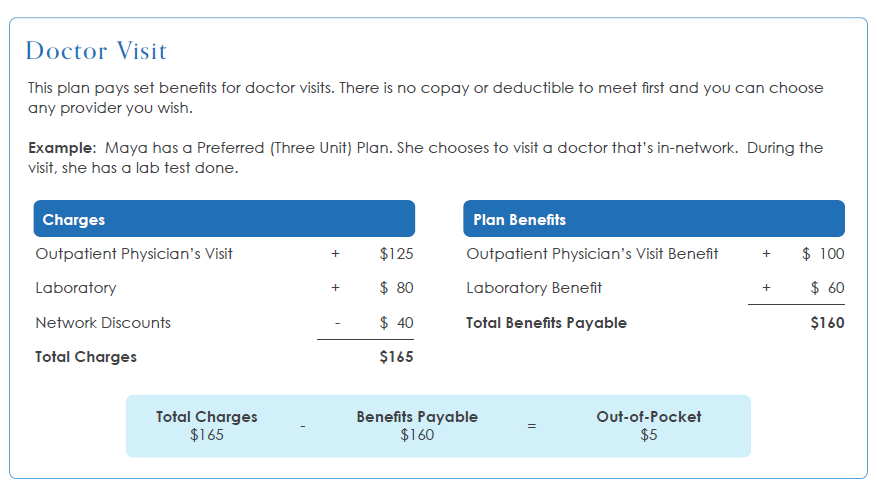

This is real insurance with an A-rated company. Quality healthcare services with set, first-dollar benefits for doctor visits, hospital stays, surgeries, preventive care, and more.

Compare and save! If you haven’t done so already, speak to your licensed agent to get a quote to compare with your current provider.

Plan Highlights

- Nationwide PPO Network – First Health Network owned by Aetna

- Easy-to-use benefits that start right away – no deductibles, copays or coinsurance to worry about

- Set, first-dollar benefits that help pay for doctor visits, prescriptions, preventive care, surgeries, lab work, hospital stays and more

- The greatest level of freedom when it comes to choosing doctors, specialists and facilities – no referrals or networks required

- Flexibility to assign benefits to providers or to yourself should you wish to take advantage of cash-pay pricing

- Unlimited, Telehealth 24/7/365, $0 virtual care visits – anytime and anywhere

- Access to one of the largest networks of healthcare providers bringing you significant discounts on healthcare services

- Savings are passed directly to you

- Plan is customized to fit your coverage and budget needs

- Access to a star line-up of fair pricing tools and resources – all available to help you save on quality care

- Critical care benefits for: cancer, heart attack, stroke, & more.

- Optional accidental death benefit

- Optional dental, vision, and hearing

What is Covered?

Partial list of what is covered:

- Hospital

- Outpatient services

- Surgeries

- Doctors visits

- Chiropractic visits

- Preventive care

- Mammograms

- MRI’s, CAT Scan

- X-Rays

- Labs

- Urgent care

- Ambulance

- Prescription benefit

- Critical care benefits (cancer, heart attack, stroke)

Take Control of Your Healthcare Plan & Start Saving Today!

Nationwide PPO Network

First Health Network is a wholly-owned subsidiary of Aetna, which helps us enhance our national provider network and further improve savings across the country.

First Health offers you a national network of doctors and hospitals located throughout the U.S.

As a First Health Network PPO member, you get healthcare services at a contracted rate wherever you live in the US.

How Does The Plan Work?

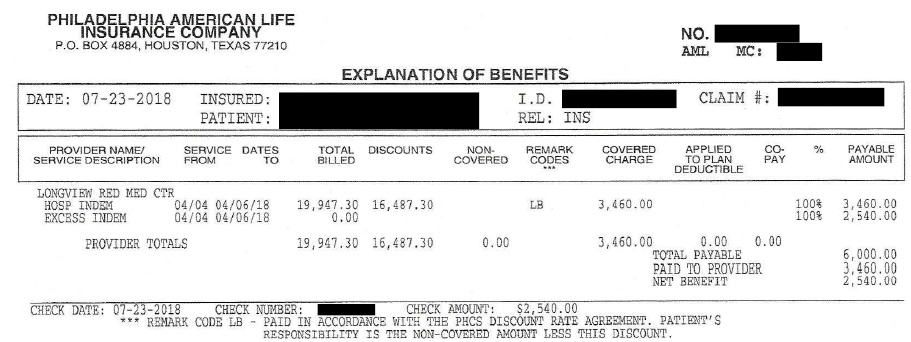

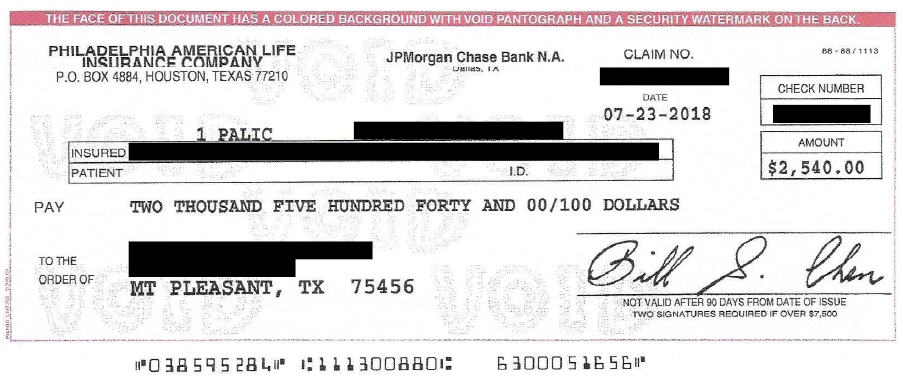

Have you ever received a check from your health insurance company for the excess benefit? Most likely not!

With our Smart Health Insurance company you receive a check for the excess benefits after the provider is paid.

Contact the licensed agent who shared this with you for questions and a free quote.

Frequent Asked Questions

We see client savings range from 20% to 70% based on their current plan.

It only takes minute for the agent to run a quote for you to see what your savings are.

The plan allows you to tailor the healthcare coverage for you and your family based on your needs and budget.

There are several additional options that can be added to your coverage:

- Dental, vision, hearing

- Critical Illness for cancer, heart attack, stroke, pacemaker implant, coronary artery bypass surgery, angioplasty, end-stage renal failure, and major organ transplant.

- Accidental Death benefit

- Disability Paycheck protection benefit

- Life Insurance

Our Health Choice Select Plan may be right for you if:

- You want to become an engaged healthcare consumer and want to take control of your healthcare coverage choices.

- You’re looking for a way to save valuable premium dollars without compromising the quality of care you receive

- You’re okay with answering health questions and going through underwriting

- You’re okay with any pre-existing conditions not being covered for the first 12 months

This plan does not have any copays. Any costs exceeding the benefit amount are the insured’s responsibility.

This plan does not have a deductible. Set benefits are paid right away for covered services.

What is First Health Network?

First Health offers you a national network of doctors and hospitals located throughout the U.S. As a First Health Network PPO member, you get healthcare services at a contracted rate wherever you live in the US.

First Health is a wholly-owned subsidiary of Aetna, which helps us enhance our national provider network and further improve savings across the country.

First Health Group Corporation provides national and regional Preferred Provider Organization (PPO) network access and other cost containment programs to help our clients manage employee benefit plans. We offer one of the largest directly contracted national PPO networks, the First Health Network, and leading regional networks, such as Cofinity and First Choice of the Midwest. We also offer a national dental network, and we have a variety of products to reduce the cost of out-of-network claims, including per claim negotiation, Medicare-based repricing and supplemental networks.

For more than 30 years, we have worked extensively with TPAs, national insurance carriers, regional health plans, employer groups, Taft-Hartley funds and Federal Employee Benefit Plans to develop and deliver products that consistently provide optimal cost and care outcomes for their members.

Optional recommended living benefit coverage can provide you the safety for the unexpected. The living benefits coverage provides additional coverage for terminal illness, critical illness, chronic illness, and critical injury, along with an all-causes death benefit.

Coverage amounts from $50,000 to $2,000,000.

The living benefits provide a lump sum benefit that can be used for out-of-pocket of expenses and living expenses such as the following but are not limited to:

- Out-of-pocket medical expenses

- Household expenses, mortgage, credit cards, car payments, insurance, etc.

- Both child and adult daycare

- Home modifications

- Regular bills

- In-home care and assisted living

After your policy has been in force for 30 days you become and with a doctor’s certification, you may be eligible to receive a benefit.

Chronic Illness: If you can not perform two of the following six activities of daily living ADL’s you become eligible to receive a benefit with a doctor’s certification.

- Bathing

- Continence

- Dressing

- Eating

- Toileting

- Transferring

Critical Illness – Qualifying illnesses include:

- ALS

- Aorta Graft Surgery

- Aplastic Anemia

- Blindness

- Cancer

- Cystic Fibrosis

- End Stage Renal Failure

- Heart Attack

- Heart Valve Replacement

- Major Organ Transplant

- Motor Neuron Disease

- Stroke

- Sudden Cardiac Arrest

Critical Injury

- Coma

- Paralysis

- Severe Burns

- Traumatic Brain Injury

Cognitive Impairment: If a doctor certifies you have become cognitively impaired within the last 12 months you will become eligible for a benefit.

- Short or long term memory impairment

- Loss of orientation of people, places, or time

- Deductive or abstract reasoning impairment

No. This plan is an alternative to ACA. With a Minimum Essential Coverage plan, the bundled plan does meet ACA compliance in many states.

Benefits are covered from day one except for preventive care (60 day waiting period) and pre-existing conditions (12 month waiting period) as outlined in the Policy.

Pre-existing conditions are not covered for the first 12 months of the Policy. Please speak to your agent or see the Limitations and Exclusions page, or review the Policy, for more information about pre-existing conditions.

Pre-Existing Conditions

Pre-Existing Conditions are excluded for the first twelve months following the effective date of coverage. A condition shall no longer be considered a Pre-Existing Condition after the date a person has been covered under the policy for 12 consecutive months. Pre-Existing Condition is a condition for which: (a) medical treatment was rendered or recommended by a physician; or (b) medicine was prescribed within 12 months prior to an Insured person’s Effective Date of coverage.

This plan provides you the freedom to choose any doctor or facility you wish. However, using the provided network can result in significant savings. The plan benefits will pay the same benefits whether you choose to go in or out of network.

Visit FirstHealthNetwork.

Select the Provider Search tool within the menu to view providers. Always, check with the provider before making an appointment as the network can change at anytime.

This plan provides you the freedom to choose any doctor or facility you wish. However, using the provided network can result in significant savings. The plan benefits will pay the same benefits whether you choose to go in or out of network.

We provide many options that can help fill in the gaps. From basic accident coverage to comprehensive cancer coverage, we can help you get the affordable coverage

Calling our concierge team before seeking care, using telemedicine, shopping for services and using the network are all some of the many ways to reduce your out-of-pocket costs.

You can apply anytime throughout the year. You do not need to wait for open enrollment to get enrolled.

Easy-to-use benefits that start right away – no deductibles, copays or coinsurance to worry about.

We know it’s hard to imagine healthcare without copays and large deductibles but the plan is designed to pay a set benefit based on the coverage you choose with no copays or deductibles.

The coverage is ideal for anyone who is relatively healthy and wants to have greater control over their healthcare coverage and expenses.

This coverage is designed to provide relatively healthy people with a quality and affordable health coverage plan option that gives you the flexibility to go to the doctors you choose.

Check with your licensed agent to determine if you are eligible based on your resident state, age, and health.

Benefits, exclusions, and limitations may vary by state.

Dental, Vision, and Hearing are optional. We have several quality dental, vision, and hearing plans available to meet your needs.

No! This is not a healthcare sharing ministry plan. This is real healthcare insurance provided by an AM Best A rated company.

If you are looking for a healthcare sharing ministry plan we do offer those types of plans. Ask your agent.

No! Once you are approved and continue making your payment on the plan you can not be canceled for health issues or filing a claim. This plan is guaranteed renewable to age 65.

One of the benefits of having an individual benefits plan is your rates will not go up if you file a claim.

Rates do increase slightly each year as you attain a new age. The increase is slight and nothing compared to traditional group coverage.

Yes. We can set up your business with a group list bill for your employees.

Talk to a doctor, 24/7/365, for $0 with Virtual Urgent Care! This plan provides unlimited Virtual Urgent Care visits with board certified doctors at no cost to you! Talk to a doctor, get a diagnosis, and even a prescription when needed, all within minutes. Additional telehealth services available at a special member rate include Virtual Dermatology Care, Virtual Counseling and Psychiatric Medical Care.

Welcome to First Health! We are grateful for the opportunity to serve you. In order to find an in-network doctor, urgent care center, hospital or other provider, use our online provider search tool. Or, contact us to talk to someone who can help:

First Health Network, call 1-800-226-5116.

Locate a provider: https://providerlocator.firsthealth.com/LocateProvider/LocateProviderSearch/

Frequently Asked Questions

Why should I use an in-network doctor or hospital? Here are some of the benefits you’ll get from using an in-network doctor or hospital:

- They’ll file a claim on your behalf

- You’ll be charged the lower network rate for your care

- Your health plan may pay higher benefits for using in-network doctors and hospitals

Can I suggest that a doctor join the network?

Yes. If your doctor is not in the network, you can ask your employer to nominate the provider.

How do providers know that I’m a network member?

Your ID card will include the network logo, which may be on the front or back of the ID card.

Do I need to choose a Primary Care Physician (PCP)?

Most PPO plans don’t require you to choose a PCP. Check with your employer or health plan administrator to find out what your plan requires.

Do I need a referral to see a specialist or other health care provider?

Most plans don’t need a referral for you to see a specialist. However, check with your employer or health plan administrator to find out what your plan requires. If you need more services for diagnosis and treatment, ask your doctor to refer you to another in-network provider.

What if I need to be admitted to a hospital or other facility?

Your health plan may require preauthorization of an admission to ensure that you receive the right care. You or your doctor should call the medical review company listed on your ID card. Be sure to show your ID card to the admissions staff when you check in.

What about behavioral health care providers?

Our networks include behavioral health providers. Please call your health plan to find out what services are covered and what the requirements are.

What will I owe to the provider?

When you use an in-network provider for services covered under your health plan, you may need to pay the provider as part of your plans cost share.

Your health plan’s “explanation of benefits” EOB will show a summary of the charges and your financial responsibility.